2019-04-16 16:43

Zhongan Minsheng was investigated and illegally raised funds under the banner of “household pension”

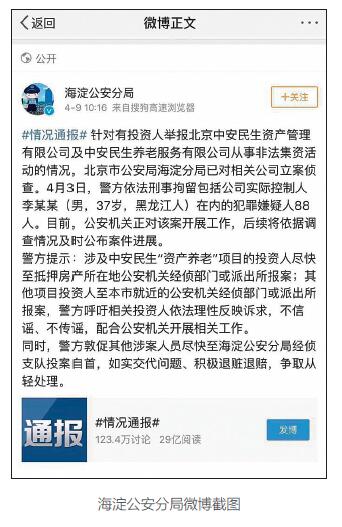

[Direct Report Network Beijing April 16] (China Economic Weekly) On April 9, the official microblog of the Beijing Municipal Public Security Bureau Haidian Branch reported that it had reported to Beijing Zhongan Minsheng Asset Management Co., Ltd. and Zhongan Minsheng Pension Service for investors. The company is engaged in illegal fund-raising activities. The Haidian Branch of the Beijing Public Security Bureau has filed a case for the relevant company.

On April 3, the police criminally detained 88 suspects including the company's actual controller Li Moumou (male, 37 years old, Heilongjiang). At present, the public security organs are working on the case, and the follow-up will be announced in a timely manner based on the investigation.

The "Zhong'an People's Livelihood" unveiled the tip of the iceberg in which some companies used the banner of "householding for the elderly" to commit fraud.

In the relevant cases, the old people are mostly introduced by acquaintances, and they are exposed to the so-called “house-to-house” wealth management products: as long as they take a house, borrow millions from the borrower, and then hand it over to people for financial management, one month. You can collect tens of thousands of "pension". Under the temptation of high economic returns, some old people signed a bunch of contracts with rudeness and eventually lost their houses because of financial mortgages.

New type of "fraud"

As early as 2017, Beijing has exposed a scam of “householding for the elderly”. On July 26, 2017, People’s Daily published "Who "stolen" the house of the elderly?", the report quoted lawyers as saying, "This is the new type of "fraud" implemented in the name of 'financial wealth'. The legal coat is dedicated to the 'silver harvest' of the elderly population."

Ms. Tang, who lives in Changping, told the reporter of China Economic Weekly that her mother, Ms. Song, had experienced a scam of “householding for the elderly”.

Company A asked Ms. Song to pledge the only set of self-housing to a third person and obtained a loan of 1.3 million yuan. The funds from the mortgage will be used to purchase the wealth management products of Company A. Ms. Song received more than 10,000 yuan of “pension” from A company to improve her life every month. However, Ms. Song did not know that the 1.3 million yuan loan was ultimately carried by her, and she needed to repay the mortgaged third party for more than 20,000 yuan each month.

A few months later, Ms. Song never got the “pension” promised by Company A. Moreover, the lender also continually calls to repay the loan, otherwise Ms. Song’s house will be auctioned.

"After my mother's heart stalk died, we discovered that she secretly mortgaged the house to the individual and purchased the product." Ms. Tang said that after discovering this situation, the family went to Company A to communicate and the other party agreed to terminate the contract. Ms. Tang coordinated with the third person and repaid more than 1 million yuan in advance, but Company A was delayed, and the financial management fund was delayed.

Ms. Tang told reporters that she communicated with the person in charge of Company A, but the other party has always loved to ignore it. Later, the business point of Company A near the home was also gone to the building. Many old people who were deceived like Ms. Tang’s mother went to the Beijing Changping Public Security Bureau to report the case. However, due to the insufficient number of people, the case could not be filed. In the end, it could only be filed by the Changping Economic Investigation Brigade.

P88

Why are insurance companies unwilling to provide housing-based products?

“It is safe and reliable to support the elderly, but it must be clearly identified.” Dong Dengxin, member of the 50-member forum of China’s pension finance and director of the Institute of Financial Securities of Wuhan University of Science and Technology, told the China Economic Weekly that the so-called “house-to-house” is Refers to the "older housing reverse mortgage pension insurance", China only authorized insurance companies to provide related products, and the various products provided by usury, P2P or asset management companies is more like a scam, and this is the "household pension" "not related. "The occurrence of these scams is mainly due to luck and greed."

The reverse mortgage old-age insurance for the elderly is an innovative commercial pension insurance business that combines housing mortgage and life-long annuity insurance, that is, the elderly with full property rights of the house, mortgages their property to the insurance company, and continues to own the house. , use, income and the right of disposition agreed by the mortgagee, and receive the pension according to the agreed conditions until the death; after the death of the old man, the insurance company obtains the right to dispose of the mortgaged property, and the proceeds will be used to pay the pension-related expenses.

In July 2014, the former China Insurance Regulatory Commission officially launched the pilot project of reverse mortgage insurance for the elderly in Beijing, Shanghai, Guangzhou and Wuhan. However, since the beginning of the relevant pilot work, the implementation of this policy has not been popular.

In August last year, the China Banking Regulatory Commission issued the Notice of the China Banking Regulatory Commission on Expanding the Scope of the Reverse Mortgage Insurance for the Elderly Housing, and expanded the pilot to a nationwide scale. At the time, although a number of companies were qualified, only a few insurance companies actually carried out the business.

Dong Dengxin bluntly said that most insurance companies are not willing to provide related products for housing care. For insurance companies, in addition to the traditional longevity risk and interest rate risk, the biggest risk facing “household pension” products is the fluctuation of house prices and related policies such as purchase restriction and property tax. “Many insurance companies are reluctant to carry out the business of housing maintenance. The main reason is that the 'oil and water' is not big, but the risk is very large.” He further explained that this product is very dependent on the mature commercial housing market, and it is easy to restrict purchases. The impact of regulatory policies. On the other hand, due to the traditional concept, the old man's house is reserved for children, and the acceptance of the concept of “householding the elderly” is still very low. Therefore, in order to promote real housing-based products, the obstacles are still very large.

|