2015-07-13 14:26

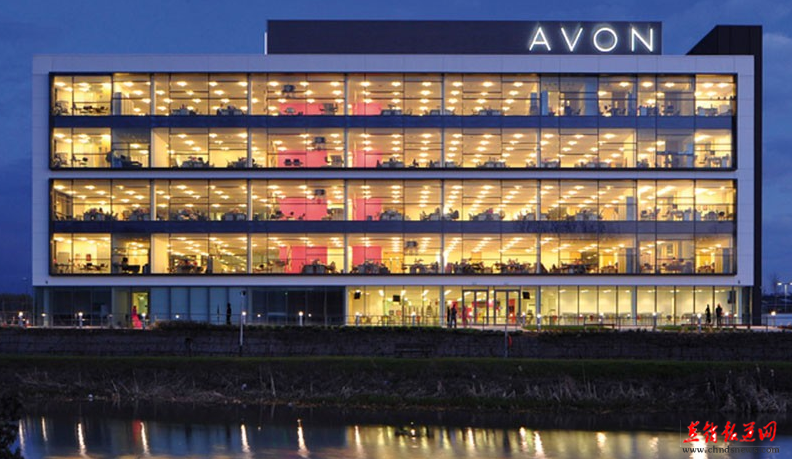

AVON 140000000 pounds to sell sub brand Earle Liz to strengthen its capital structure

|

[CNDSN7] 13 days (Beijing daily) after a series of rumors of AVON's acquisition of's hands, but the sale is only sub brand Earle. Boots Alliance Inc. Walgreens (Boz Wall Green), the 140000000 pounds of transactions will be carried out in full cash form. AVON group said that all proceeds from the above transactions will be used to redeem the $2.5 in March 2016 maturity.

Liz Earle is by the name of health beauty journalist and a friend, beauty industry marketing expert Kim Buckland in 1995 founded, pre has been through the Avon sales the self-developed products, currently has more than 600 employees. Avon group in March 2010 acquisition of Liz Earle, similarly to a one-time cash transactions completed, but did not disclose the purchase price, and said the deal will help Avon to actively expand the company occupies in the anti-aging products on the market the share, but not on a per share earnings have a substantial impact. In fact, Earle Liz has been independent of the group's core direct sales operations. Data show that in fiscal year 2014, Earle Liz accounted for only 1% of the group's revenue and adjusted operating profit in Europe, the Middle East and Africa, the proportion of about 3%.

For consecutive losses for three years, Avon's group, Liz Earle did not bring digital brisk performance, stripping no suspense. In the first quarter of this year, Avon group income year-on-year decline to 17.8% 17.942_yi billion, cut 12.5% to 1.473 billion net loss, not to market expectations. In May this year, a PTG Capital Partners Ltd., the company's desire to close to 3 times the market value of a full takeover of Avon group, which makes the latter shares soared 20%, but the offer was quickly expose as an attempt to manipulate the profit shares scam. 3

Editor: small Shen

|