2016-07-27 17:21

Vigilant use of corporate credit information publicity system to implement illegal fund-raising

Direct reporting network Beijing July 27th (China business newspaper) with the end of the annual report, the number of financial services companies listed in the business exception list increased significantly. Was included in the list of the abnormal operation mainly have three: according to the registration of residence or place of business can not get in touch, not according to the ordered deadline public information about the business and public information concealing the real situation, fraud. (Figure), which are as follows, enterprise credit information publicity system in information publicity anomaly in this area, in addition to the illegal enterprises concealed, fraudulent use of other information outside hidden risk of illegal fund-raising.

Wary of new means of illegal fund-raising

The so-called illegal fund-raising refers to companies, enterprises, individuals or other organizations without approval, in violation of laws and regulations, through improper channels, to the public or collective funds to raise funds. The main characteristics are: one is without the approval of relevant departments in accordance with law or borrow funds in form of legitimate business to absorb; second is through various media, site promotion, print advertising, mobile phone text messages and other means of publicity to the community; a commitment in a certain period of time to money, real, equity, debt service payments or payment in return; four is to the public that the community is not a specific object to absorb funds. Various forms of illegal fund-raising, mainly including debt, equity, commodity marketing, production and operation of the four categories, mostly under the banner of Internet banking banner, fictional investment projects.

Although the functional departments of illegal fund-raising continues to blow, but because of the choice of financial investment channels are not many people, limited to stocks, buy funds and bonds, bank financing, fixed deposits and other limited investment. Together with some people legal consciousness, lack of investment knowledge, the face of criminals's promise of "Internet banking" high interest temptation ability to distinguish the difference between, in the rich psychological blind investment, is still a huge risk of incidence of illegal fund-raising.

Recently, the Beijing Municipal Trade and Industry Bureau Chaoyang Branch found on suspicion of using corporate credit information publicity system to cheat investors trust case.

An investment fund management Co., Ltd. to investors, investors can have a corresponding proportion of the company's equity investment, and enjoy regular dividends, due to return to the high income. Investors in investment, the company employees in the national enterprise credit information publicity system (Beijing) and Beijing enterprise credit information network "public information" part of "shareholder and investor information" column, self publicity 1214 "shareholder" and with investment information, the total amount of close to 80 million yuan, the capital contribution is the largest of a name "shareholders" paid amount reached 800 million yuan, more than multi to below 50000 tons of small investors.

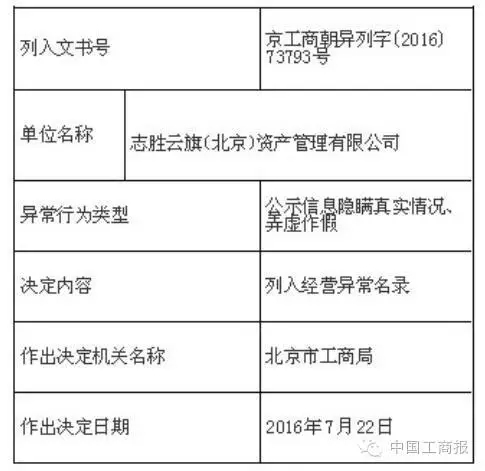

According to the investigation, the company's industrial and commercial registration information display its registered capital 30 million yuan, paid in capital is zero, only one person shareholder and three natural person shareholders, and the company self publicity of the overall number of "shareholders" far beyond the China's "company law" for the number of shareholders of a limited liability company shall not exceed the limit of 50. After a field inspection, the Beijing Municipal Trade and Industry Bureau Chaoyang Branch found that the company was suspected of illegal fund-raising, and according to the inspection situation will be included in the business exception list. At the same time, Beijing city industry and Commerce Bureau Chaoyang Branch will be informed of the relevant circumstances of the district finance office and the public security organs.

In recent years, the national enterprise credit information publicity system has been widely used in society. As of June 30th this year, the national annual report of 2015 companies 18 million 166 thousand annual report, annual report publicity rate of 88.3%. The country has a total of 15 million 801 thousand enterprises publicity immediately information. At present, the national average of 40 million people a day to log on the system.

At the same time, all walks of life to the national enterprise credit information publicity system (Beijing) and Beijing enterprise credit information network awareness is also increasing year by year. The company is using the credibility of the publicity system, to investors confused or substitution of the enterprise own publicity information "and the administrations for Industry and commerce registration information concept, through self upload information publicity means will investors name, investment amount and time information display in the corporate credit information publicity system, in order to gain the confidence of investors, to achieve the purpose of illegal fund-raising.

Although the reminder of the publicity system in related page has "corporate public information by the enterprise to provide, enterprise public information authenticity, legitimacy is responsible, but due to some people at this stage can not understand clearly" corporate public information "and" business registration to remember the difference between information, extremely easy to potential risks after the outbreak of the investors will point to the contradictions of enterprise credit information publicity system maintenance, the industry and Commerce Department.

Measures to combat illegal fund-raising

According to the data of Beijing network information office and the Municipal Finance Bureau announced last year, only 2015 years 1 month to 5 months, Beijing new cases of illegal fund-raising in 51 cases, involving 33 billion yuan involving more than 2900 investors, the new case number and 2014 earlier than 64.5% growth. As of May 2015, the city accumulated a total of 221 cases of illegal fund-raising cases, involving 36 billion yuan, involving 276 thousand people. Among them, the number of Chaoyang District City, Beijing, the number of cases in the city accounted for more than 50% of the proportion of illegal fund-raising hardest hit.

In response to this situation, Beijing city industry and Commerce Bureau Chaoyang branch in the beginning of this year to suspend the registration of investment enterprises, the registration of investment companies to take to tighten policy. At the same time, according to the law regulation, collaborative supervision, innovation supervision principle, the branch to take the following measures to strengthen the promotion of illegal fund-raising.

First, combined with the typical illegal cases of financial enterprises, invited experts and scholars on the 4 kinds of financial contracts were analyzed, the production of the illegal fund-raising small knowledge and financial contract risk tips promotional manual.

Two is to strengthen the sector linkage, and district finance office to strengthen communication and coordination, and jointly carry out the work related to the promotion and risk.

Three is the depth of the area 492 communities and village committee to carry out risk prevention and control and guidance, combined with industrial and commercial work stations, consumer groups and other forms of propaganda, to carry out on-site publicity and consultation activities.

Four is to carry out special rectification action, according to the financial district office provides the list of enterprises to the jurisdiction of financial enterprises launched a comprehensive investigation, while focusing on the shopping malls, supermarkets and other personnel intensive places the kind of financial enterprise publicity were examined to strengthen financial investment and payment service class routine monitoring and supervision of the advertising.

Improve the publicity system related recommendations

At present, the industrial and commercial sectors of the regulatory mechanism has been comprehensive reform of the inspection system into a double random system of random checks. Although the law enforcement officers in the random work, once found such use of enterprises to deceive investors to conduct their own public information to deceive the behavior of investors will react quickly, but limited supervision of human difficult to do all the time.

The author suggests that the business sector needs to start from the following aspects, the joint relevant departments to strengthen the supervision of the class of financial enterprises, to reduce the occurrence of the alleged illegal fund-raising case.

One is recommended in the national enterprise credit information publicity system, corporate publicity information part of the contents of the contents of the set of bytes limit prompts. Once the program found a company in the part of "public information" fill in the content exceeds the limit the number of words automatically prompts the regulators, by law enforcement officers to carry out a preliminary manual review, for the first time can effectively guard against the risk.

Two is to increase publicity efforts in all kinds of media. For the Beijing region, the relevant departments can be in two systems of the national enterprise credit information publicity system (Beijing) and Beijing enterprise credit information network to up more objective way and position of enterprise public information independent of the validity of legal presentment, to improve information access to people's vigilance. To let the society of enterprise public information independent of the concept of a more in-depth understanding.

Three is to establish information automatic reporting system. Will be through the enterprise credit information publicity system found suspected illegal fund-raising subject timely notification to the relevant departments, strengthen communication of information sharing, to establish and improve the reporting system, to further improve the Joint Disciplinary Mechanism and joint enforcement mechanism, strengthen inter departmental task force.

Four is to increase the means of restriction and legal basis. For the use of publicity system of investor confidence to cheat, according to the current laws and regulations, the business sector can only according to the type of publication of false information will be included in the enterprise business directory exception, recommends that the first such enterprise publicity information content initiative by the business machine close to be shielded, research and the introduction of new penalties, such as the prohibition of the legal representative of the enterprise and shareholders for re investment. (Beijing city industry and Commerce Bureau Chaoyang Branch Ke Yuanpeng)

Interpretation of the news hot spots, showing sensitive events, more exclusive analysis, in the "things" WeChat, scan two-dimensional code free reading.

|