2016-06-03 16:30

When the direct experience of the original stock Li Gui turned out to be Li Kui

Direct reporting network in Beijing in June 3rd (the first direct network) recently, the original stock appears frequently in the public view, but not because of what made the rich myth, but a variety of MLM scam was exposed.

In fact, we have around play with a lot of "primitive" capital game case, purely MLM organizations such as the cover net ", known to enter the direct sales companies such as morning farmers in Shandong, Hunan Yi Kang, and even has won the card companies such as Hunan Yandi.

So, these so-called "original unit" is really making the artifact? When the original unit in direct selling, why will bear the consequences of financial marketing?

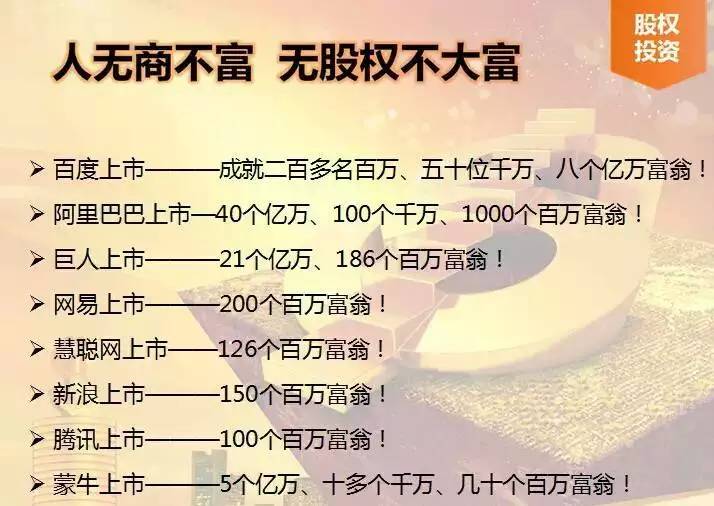

No equity is not rich

Original shares are listed before the company issued shares. In China's securities market, "the original unit" has always been a synonym for profit and wealth.

In the so-called "first half of the market", the original unit is a large number of transactions. China's securities market establishment of early, some people acquired from a semi market securities in after the listing price increases by a factor of ten, which flourishes, become China's securities market made the myth of the rich.

Only occupies Alibaba less than 10% of the shares of the Ma, once listed, with the hands of the "primitive", leapfrogged entrenched years of Asia's richest man Li Ka Shing become when the richest man in China. And another hidden in Funiu mountain pig groom, animal husbandry, the original shares chairman Qin Yinglin, accompanied by a listed company, the same with the hands of the original shares, became the richest man in Henan.

This is the strength of the original unit. The capital market the emergence of a rich mythology, let "yuanshigu" become rich quick "xiangbobo".

The original stock sold like vegetables

With the theory of people without equity is not rich in the capital market has been verified, the whole people turned a crazy chase the original shares of the times. Coupled with hot new board, new plate, the new round of IPO offering tide around the emergence of a wave of original stock investment peak. Regional equity trading market listed companies showing geometric growth, some companies have begun to take this commitment to market expectations, and publicly sell the original shares.

On December 19, 2015, Shandong morning farmers health in a hotel held shares of an elaborate ceremony, the site attracted more than 2000 members in, in Limited buying the company's stake in the original link, the participants like to buy food as competing subscription card, crowded scenes, comparable to the spring when the fire station.

Staff morning farmers said original shares and not only in light of one member company, social workers can also buy casually, is currently a yuan a share, "do you want to buy how much you can buy as much, next year, the company can be listed. When the time comes, will price repurchase shares, then you can make money."

Reference uncle although not professionals, but on some basic common sense said the current direct selling industry prevailing primitive rich mythology in the end by unreliable.

1, low barriers to entry: "yuanshigu" market dragons and fishes jumbled together

One of the reasons for the sale of raw stock is so crazy, in order to facilitate the financing of small and medium enterprises, the regional equity market entry threshold is very low. Like the Q board of Shanghai Equity Trust trading center, the threshold of the registered capital of only 500 thousand yuan. And more relaxed, intermediaries need only issued 20% of the registered capital verification report to. Threshold so low, naturally attract a large number of enterprises influx.

Once inside the enterprises, inevitably mixed with many swindlers company, these companies simply do not have the qualifications listed, but the name of misappropriating the banner of the listed only.

And in fact, if cast a real company, even the original shares cannot change hands, may has already been regarded as investors lucky, meet the investors of a shell company is powerless. In reality, spend tens of thousands of dollars can be registered or buying a shell company". And then, its business packaging for environmental protection, agriculture, new energy and other fashion themes. However, these business companies claim, is likely to exist only in the beautiful brochure.

2, low risk and high returns: an irrational bright vision

These selling original shares of enterprises in order to attract investors, often claiming that the original investment can achieve low risk, high returns, such as the annualized rate of 80%, after the listing of the company to 3 times the high price of the review of shares and so on.

For investors, the "low risk, high return" very tempting, but in the real world can really do it?

American economist K J Galbraith said that the history of money has been plagued by people: either a lot but not reliable, or reliable but scarce, the two will be one of the.

Not only up not down the market, there is no bag to win without losing the product. Like gambling, there is no eternal winner. So, the so-called high return low risk or even zero risk situation, in real life, is basically impossible to exist. Any promised high returns, are all part of the institutions and individuals, by investors anxious to make money psychological to induce investors, exaggerated publicity, in order to achieve the purpose of profiteering.

3, the stock market to surgery: rich dream into a nightmare

The essence of the original stock scam is: capital to earn money to go, leaving only a future is expected to allow investors to buy, and most of the cases this is expected to be difficult to honor. All the scam has been the market see through the day, this time the crisis will erupt.

As a specification of the securities market, the securities investment products listed transactions, liquidity is the first. And "primitive" is because it simply does not have the legitimate flow channels, only through the "private transfer" were, which is the "soft rib" is located. Investors in the investment of the original unit, due to the high liquidity of the securities is estimated to be insufficient, so as to be able to transfer as long as they can buy the erroneous zone.

Take Shandong morning farmers, the sales staff said that if successful buy original shares can also be the stock certificate sold, what procedures do not need, by the investors themselves set.

In fact, investors only in the Shanghai Stock Exchange, Shenzhen Stock Exchange and bear the new board trading settlement of the shares of small and medium-sized enterprises transfer system the three open market stock trading, belong to the scope of legal protection; besides other trading market in the listing is not the same as in listing, and the listed companies to sell the so-called "primitive", which belongs to the transfer of private, not by the legal protection.

Although investors can get a certain price difference from the middle of the transfer or get a certain dividend, but can not determine their own hands of the original unit in a number of transfer, is not received the last stick. Like buying vegetables to buy the original stock, it is likely to be the last to buy a dish can not buy, the hands of the equity Certificate in the end can only be equivalent to a piece of paper.

4, the original gift shares: financial pyramid vest

In addition to the high returns, overnight, the accrual temptation, "listed company" the feint of halo to the illegal fund-raising more openly vest.

In many online distributors of Yan biological propaganda, "the background of listing Corporation has been repeatedly mentioned. A direct sales personnel told reporters, said: "Yandi biological is sunshine holdings, a wholly owned subsidiary, and the company also has a listed company, sunshine shares, so Yan biological is quite rich a financial company.

This background so that Yan Di's original shares become hot demand, Yan Di's performance also doubled last year. In fact, Yandi biological repeatedly been media exposure "membership development bundled sales of the original shares" of the problem, the alleged financial pyramid schemes, and questioned acquiescence Yandi biological matter. Yandi sales of bio system people have also repeatedly mentioned the "original equity incentive", namely, performance reached a certain degree of equity sales bonus system of the company.

More than Yan company itself engage acquiescence direct binding "primitive" and its biological Hui Ze system, Huasheng system engage in so-called "primitive stock incentive", without obtaining approval from the securities regulatory departments unauthorized publication of the initial public offering shares up for two years.

Shandong Chennong mode is the same: ten thousand yuan to buy the original stock, can give the same amount of products.

But the evidence suggests that Yan biological so-called "original stock incentive", in fact has been suspected of financial marketing. Insiders also said "Yandi model" is very dangerous, once the collapse, to company of Yan Emperor and the direct selling industry bring enormous negative effects.

epilogue

In fact, the original unit itself is not wrong, wrong is that those who use the original unit set up a scam. Direct marketing itself is not wrong, wrong is the name of the name of the banner of direct marketing people. And when the original unit in direct selling, and there is a large set of people began to weave a new scam. But no matter what kind of scam, unveils imagery, in essence, is the same, it is nothing but "can not lose, credit endorsement, rich model of the set.

"Original shares are valuable, hard and hard money price is higher," the direct selling enterprises should not use the original stock fraud to corrosion of the industry, direct sales people do not believe the original stock myth.

Let the stock market return to the stock market, so that direct sales return, but also a pure land, I think this is all the people who love this industry have a simple vision.

Interpretation of the news hot spots, showing sensitive events, more exclusive analysis, in the "things" WeChat, scan two-dimensional code free reading.

|